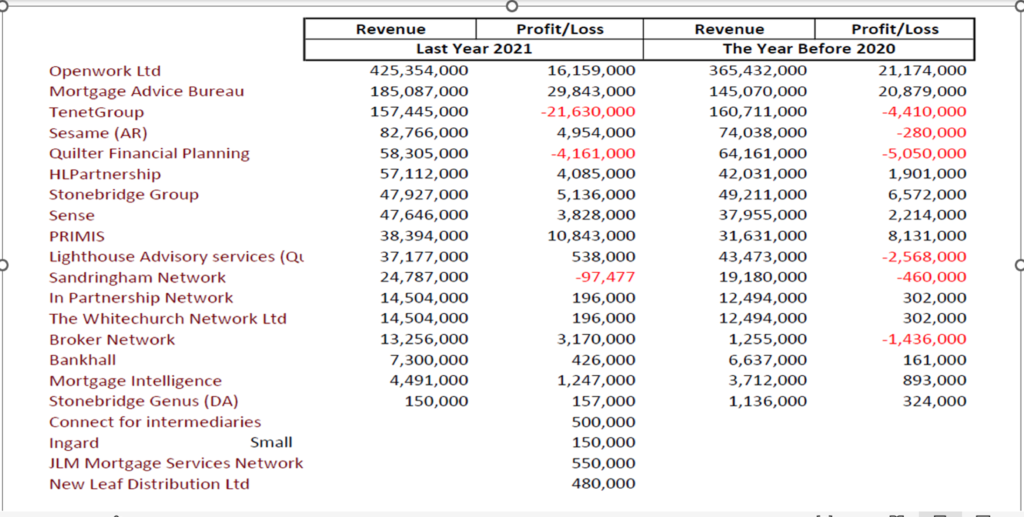

List of Tenet’s Group Companies and Their Financials

Comparison of Financial Results of Mortgage Networks

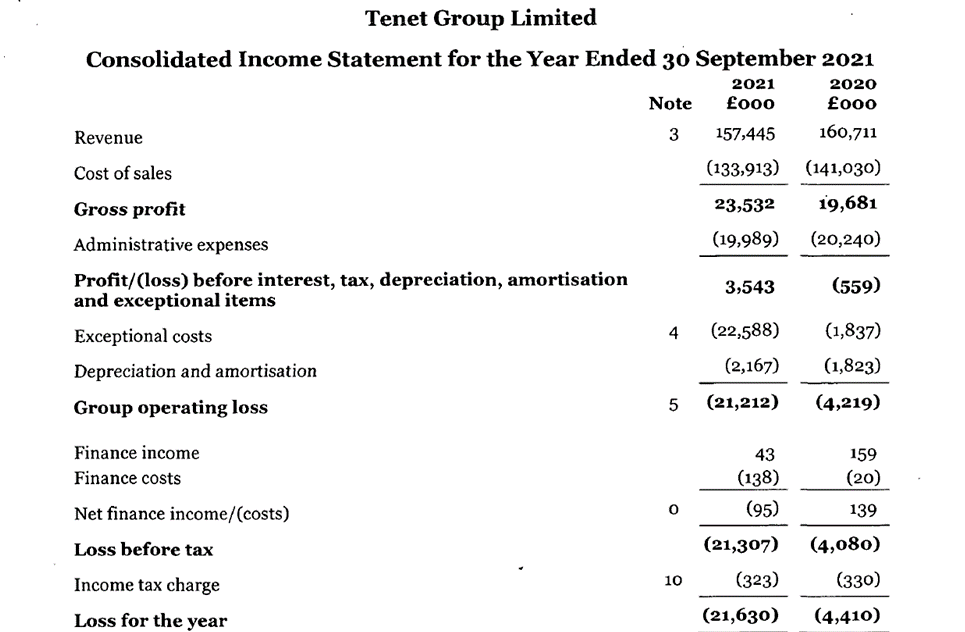

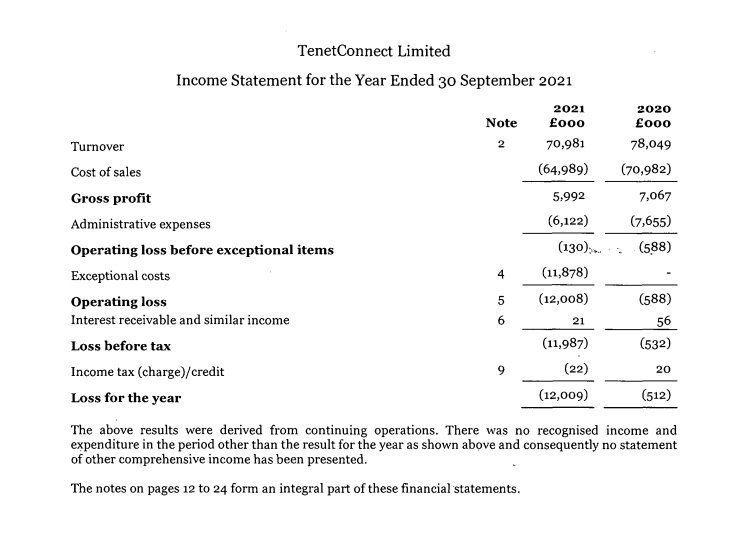

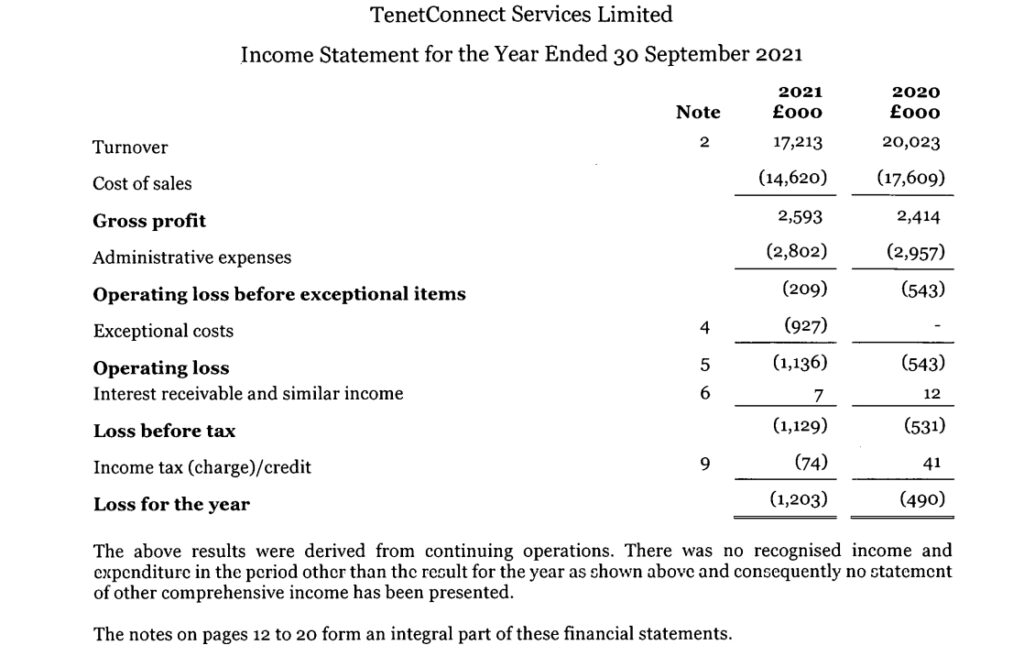

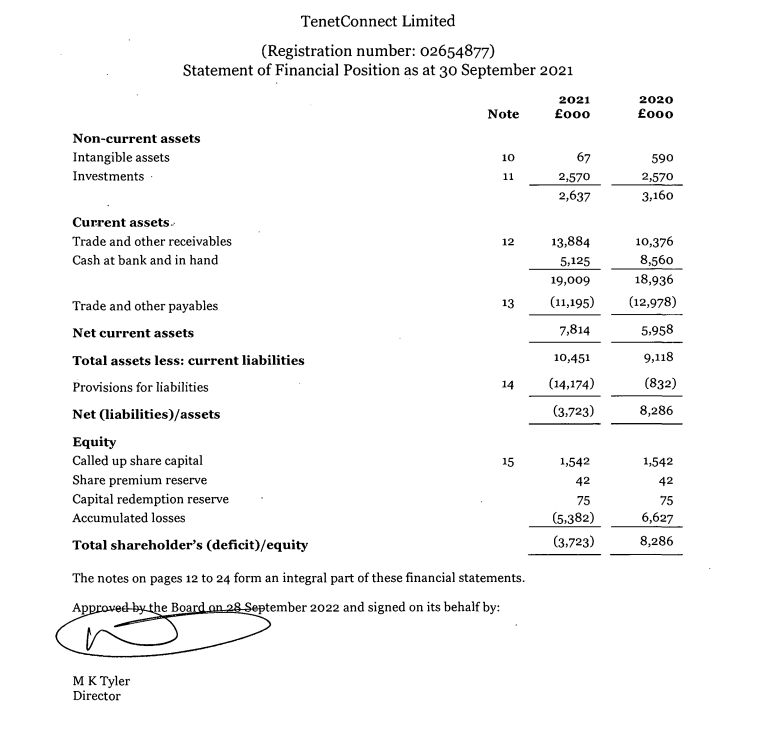

Tenet Group is in huge losses. Please see the financial results below. The loss for the year 2021 is extra ordinary £21.6 million which is a record. This has put the Tenet Group management under so much pressure that, as per a news report, the shareholders have hired a consultant to put Tenet Group on sale. The financial situation of Tenet Group is under extreme stress. The financial year end of Tenet Group is 30 Sept. So the annual accounts for the year ended 30 September 2021 were supposed to be filed with the companies house within nine months i.e. 30 June 2022. But the accounts were filed on 04 October 2022. Please see this link.

It is a rumour in the industry that the external auditors of Tenet Group refused to sign the accounts as a going concern. Due to this reason and due to pressure from FCA, the shareholders injected fresh capital in the company and only then the auditors signed the accounts.

The Tenet Group is basically not solvent if you see the accounts and losses. No company can run in this kind of situation. There are some unusual items in these latest accounts such as British Steel Pension Scheme Provision but even in the last year, the losses of Tenet Group were £4.4 million. See below.

The turnover of Tenet Group is also reduced from £160 million to £157 million. The firms associated with Tenet Group are leaving in droves due to the unprofessional attitude of the management to join other network.

As per FCA register, only four new firms joined TenetConnect in 2022 and a total of 39 firms left Tenet Connect Ltd. Some of these firms were attached with Tenet since 2003. Similarly, 59 firms left TenetLime Ltd in 2022 whereas none joined them in the same period.

No other mortgage network is struggling financialy except Tenet Group and Quilter. The reason of Tenet Group’s demise is its incompetent management. They have destroyed one of the largest indpendant network of the UK.